Break-Even Analysis

Determining When a Product Becomes Profitable

© iStockphoto

s5iztok

Use Break Even Analysis to find the point where your investment starts to pay off.

In business, your ultimate objective is to make money.

So, when you launch a new product or purchase a new piece of equipment, how do you know whether a potential investment will at least cover the costs associated with it?

You could simply make a wish and hope it all works out – or you can evaluate the project more formally to see if it makes financial sense. One way of doing this is to complete a Break-Even Analysis.

This determines the break-even point – the level of output at which the revenues generated by a project equal costs. At the break-even point, you don't make or lose money. Once you pass break-even, you make money; below break-even, you lose it.

Using a Break-Even Analysis, you can answer questions like:

- What are the projected profits and losses at any given output level?

- At what minimum sales level do you avoid making a loss?

- Do your sales projections for a new product exceed break-even?

- If you drop a product, will your break-even improve?

- How will raising or lowering prices affect your profitability?

- If costs increase, what is the effect on your break-even position?

- How does investing in facility improvements affect your break-even point?

Calculating the Break-Even Point

Determining the break-even point involves a simple mathematical equation. You reach break-even at the point where total costs (TC) equal total revenues (TR), or

TC = TR

Total costs have fixed and variable components:

- Fixed costs (FC) remain the same, regardless of your output. Rent, insurance, and base salaries are examples of fixed costs.

- Variable costs (VC) change with the number of units produced or sold. Examples are materials, sales commissions, and direct labor costs. Therefore, total variable costs (TVC) equal the variable costs multiplied by the number of units, or TVC = n x VC, where n is the number of units.

- Total costs equal total fixed costs plus total variable costs: TC = FC + (n x VC).

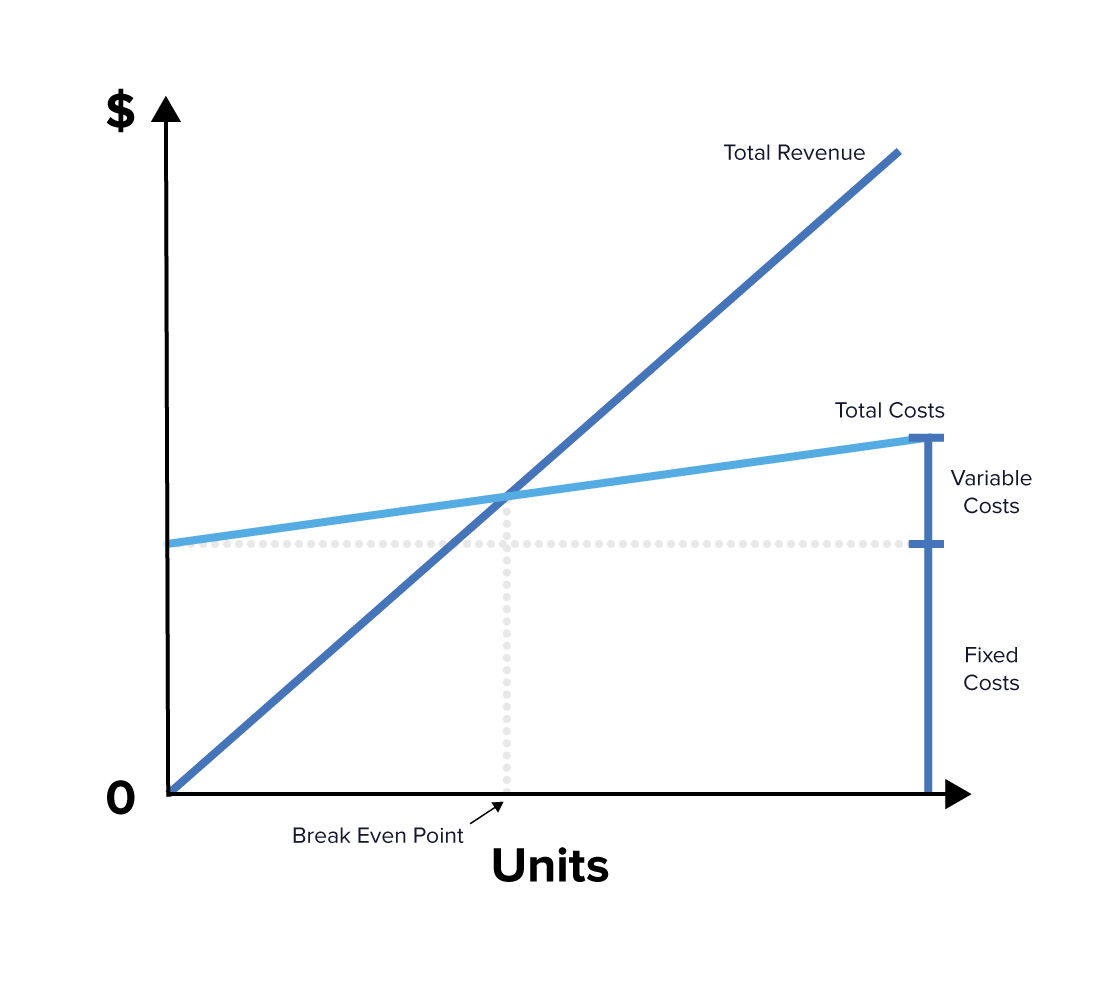

You can see how these costs vary with the number of units sold in figure 1, below:

Total revenue is the price charged per unit multiplied by the number of units produced or sold: TR = n x P, where P equals the unit price.

Again, you can see the line for Total Revenue in figure 1, with break-even occurring where the TR line crosses the TC line.

You can calculate the break-even point by expanding the break-even equation:

TC = TR

FC + (n x VC) = n x P

Solving for n gives you the number of units you need to break even:

n = FC/(P – VC)

If you have a specific profit target, you can use the break-even equation to calculate the number of units you must sell to achieve that target:

n x P = FC + (n x VC) + Profit

n = (FC + Profit)/(P – VC)

A Break-Even Example

Let's imagine that you're considering launching a new product. Market research has shown that customers will pay $115 for it, and your sales team is confident that they can sell at least 500 units per month. The equipment you'll need to produce the product costs $900,000 and this will be spread over three years, giving you a fixed cost of $25,000 per month. You need to decide if the product is financially viable.

| Fixed costs/month | $25,000 |

| Variable costs/unit: | |

| Direct labor | $20 |

| Direct materials | $15 |

| Shipping | $5 |

| Sales commission | $10 |

| Total VC/unit | $50 |

| Price/unit | $115 |

To calculate the break-even point, use this equation:

n = FC/(P – VC)

n = 25,000/(115 – 50)

n = 384.6

The break-even point is 385 units per month. This is below the minimum sales volume that the sales team thinks they can achieve, so the product has a good chance of making money.

Break-Even Analysis can also be useful in thinking about pricing. For example, how much would the break-even point increase if you reduced the price to $105? This should increase the sales volume, but would that compensate enough for the lower price? Using the break-even point, you can manipulate a variety of costs and revenue variables to understand the effects of various scenarios.

Limitations of Break-Even Analysis

A Break-Even Analysis is best used as a preliminary planning tool. In our example, there are many other issues to consider. What is the opportunity cost of spending $900,000 on the equipment as a capital expense, as opposed to investing the money in something else? Would another product give a better Return on Investment (RoI)?

Break-Even Analysis is also very restrictive in what it includes in the equation. Cost and revenue calculations can be much more complex than those considered in a Break-Even Analysis. Material costs and other costs can change dramatically, and it's not always clear which fixed costs should be included. For example, what portion of executive salaries should you use? Break-Even Analysis also doesn't consider cash flow or how the proposed project might affect economies of scale, nor does it take into account the value of money as it varies with time.

For these reasons and many others, Break-Even Analysis is most often used in the early stages of thinking about a decision. From there, you can decide whether further analysis is needed.

Key Points

Break-even is the point at which the costs associated with production equal the revenue generated.

To use Break-Even Analysis effectively, you should have a reasonable understanding of the costs involved in your operations.

When it's used as a general decision-making tool, Break-Even Analysis can highlight projects that have a good chance of contributing to profits and those that don't. It's not the tool to use for your final decision, but it can be useful for the early planning stages.

This site teaches you the skills you need for a happy and successful career; and this is just one of many tools and resources that you'll find here at Mind Tools. Subscribe to our free newsletter, or join the Mind Tools Club and really supercharge your career!

Well done for persisting!

Some people find math easy and intuitive, but many of us struggle with it to a lesser or greater extent. However, there's a point in our careers where we have to "bite the bullet" and understand these finance concepts - finance blindness just isn't an option beyond a certain stage.

Best wishes!

J

May